[sgmb id=”1″]We all have done taxes and got frustrated before, right?

I strongly dislike doing taxes: numbers, rules, and lot’s of craziness to follow as a self-employed person. Every tax season I scream: HELP! HELP! HELP!

Can you relate?

If your answer is YES, then I have a SOLUTION that will save you alot of stress and headaches! I could tell you that I spent countless hours studying taxes, and now I am a tax expert but that’s not the case! Instead I contacted my friend, an experienced tax consultant, who knows the ins and outs of tax preparation and planning, and provides proficient business consulting.

Pretty impressive, huh? She is as smart as she sounds!

Let me introduce you to Sydney Fritzel.

She has done daycare taxes before and kindly contributed 5 important tips that actually make sense and are easy to understand! She also offered her professional services to all of you Fabulous Provider ladies. If you are interested and need help with filing taxes please contact Sydney for pricing and her availability.

Sydney Fritzel

715-848-5404

sydney at hackcpa dot com

TAX TIPS FOR DAYCARE PROVIDERS – by Sydney Fritzel

Tax ID

– Most common business type in operating daycare is a ‘Sole Proprietorship’. This type allows you to file your taxes through your individual tax, Form 1040 by adding Schedule C. Unless you have employees, it’s up to you whether you would like to have Employer Identification Number (EIN) or not. ‘Sole Proprietorship doesn’t require to obtain EIN like partnership, C-corporation, S-corporation. However I would recommend you to get an EIN to protect your Social Security Number (SSN). Daycare expense is one of the tax deductions (Form 2441) and you must provide year end statement for your clients with your EIN or SNN for them to claim expenses they paid.

Keep all the receipts (expenses like food for children, repair, supplies etc) and organize them at least quarterly

-the more organized you are, the more efficient you will be when it comes to getting done your taxes.

-Ex) Make folders for quarterly and inside of quarterly folders, make income folders and expenses folders and keep all the checks you received (or copies of checks) and any receipts from your business expenses

-Especially if you are planning to get your taxes done by professional tax preparer, organized data will save their time and therefore save your money as well.

Bookkeeping : use QuickBooks or other accounting software to keep track sales receipts & expenses

-If you want to be seriously organized, you can purchase accounting software to organize your financial information

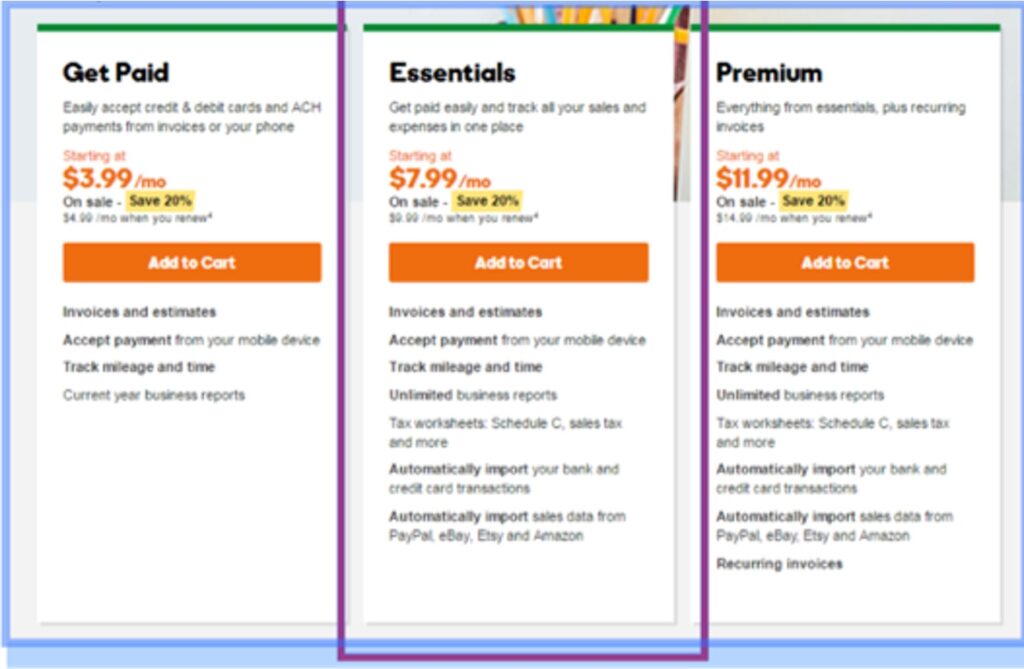

Go daddy.com – Essentials

Go daddy.com offers a bookkeeping service with tax worksheet for Schedule C. You can also import your bank and credit card information automatically. Once all the financial information is ready to go, it will present the tax worksheet for you. You can just input the data on your tax return. It is very easy to use as well.

https://www.godaddy.com/email/online-bookkeeping

QuickBooks Online – Simple start will be just fine.

It doesn’t offer tax worksheet but it can generate various reports and statements. If you would like to generate year end statement for your clients out of your bookkeeping software, this will be a better option than GoDaddy Bookkeeping.

Both GoDaddy Bookkeeping & QuickBooks Online work on your PC, tablets, and phones. If you would like to be portable with your bookkeeping, these are the answers for you.

Estimated taxes or making extra withholding

Your income from daycare will be subject to social security (12.4%) and Medicare taxes (2.9%) on top of federal income taxes, just like your W-2 income. If your net income from daycare is $1,000, you are responsible for self-employment tax amount of $153.00, which includes both employee and employer portion. Thankfully, IRS lets you deduct half of that amount before the calculation of the taxable income. Therefore, in the end you pay $76.5 (7.65% of your net income) self-employment taxes.

As I mentioned earlier, you still need to pay income tax on this net income. This is the tricky part. Your tax bracket for federal income tax will be depend on your total household income. This means, if you file married filing jointly, your spouse’s income is combined to determine the tax rate for your total household income. Sometimes this gives you a surprise with ‘owing taxes’ instead of a refund when you do your taxes in your second year or third year of your business. If your quarterly net income is higher than last year (QuickBooks comparing reports come in handy) and everything else will be same, you might think about making estimated taxes or making extra withholding through your spouse’s paycheck to avoid paying in at the end of year.

How long should I keep the records?

Finally your taxes done, headaches gone! After getting your taxes done, you might eager to get rid of all your junk. I totally understand, but wait. IRS requires to keep your records at least 3 years and depends on the circumstances, it requires longer than that. So make sure you keep them somewhere safe and read through the link below if you need.

https://www.irs.gov/businesses/small-businesses-self-employed/how-long-should-i-keep-records